Taxation is a key part of any business process irrespective of the niche. We all know that taxation rules differ from one country to another and hence tax calculation for various payment methods vary across different countries. This variance and differences also lead to errors in tax calculation. The tax errors on the other hand can put a company in a difficult position in regard to the legal complications.

NetSuite as the most comprehensive cloud ERP system takes care of every aspect of business operation including taxation, financial management, compliance and regulations, CRM, inventory management and pretty much everything. Just like NetSuite accounting module, SuiteTax is the NetSuite module that helps businesses to deal with their taxation requirements.

The NetSuite SuiteTax offers a comprehensive solution for taking care of all taxation problems and ensures automating the tax calculation across all jurisdictions. With SuiteTax implemented in your company, you can be completely free from all the worries concerning taxation irrespective of the location your business is operating from.

What is SuiteTax and how does it work?

SuiteTax refers to the NetSuite module for calculating all kinds of taxes and streamlining the process of tax payment for any business. SuiteTax ensures accurate tax calculation based on the tax rules, tax slabs and parameters set by the federal authorities of the particular country where a business is operating. It is the most comprehensive tax calculation and processing tool that can accurately calculate and prepare tax files based on the tax rules in countries like the US, India, Brazil, Vat countries and others. A NetSuite implementation partner with expertise in accounting and financial modules can help a business to derive maximum benefits of the module.

Integrated locally with the NetSuite cloud ERP platform, SuiteTax ensures optimum efficiency in respect to the taxation process. It helps a company by integrating various tax calculations and bringing them within a consolidated reporting function. Instead of using a separate software for tax calculation companies can use this NetSuite sales tax integration module along with NetSuite financial tools used for billing, sales, revenue recognition, and payments.

SuiteTax being integrated with billing processes and accounting modules provides accurate tax figures and data for reporting and calculations at the time of transactions. Most importantly, SuiteTax handles all kinds of taxation components including both direct and indirect taxes.

Key Advantages of NetSuite SuiteTax to Consider

NetSuite SuiteTax makes things easier for the US and global companies in dealing with difficult tax structures in countries such as India and China. Since many companies use third-party solutions to handle complicated taxation needs, SuiteTax allows working in collaboration with third-party tax tools as well. SuiteTax is optimised to address customer specific taxation needs.

Some of the key advantages of NetSuite SuiteTax include the following.

- A business by using SuiteTax can completely do away with manual tax calculation as the tool allows integrating in-built tax logic for the system to calculate tax automatically for every transaction.

- SuiteTax automatically updates itself on the latest tax regulations and tax slabs and parameters and thus it gives a business freedom from watching over evolving tax rates and incorporating the same in transactions.

- SuiteTax allows integration with multiple tax partner tools to allow automated tax calculation in different countries and jurisdictions. There are experienced NetSuite integration services who can help you with custom SuiteTax integration.

- SuiteTax offers a solution that takes care of both indirect and direct tax calculation. It adheres to the compliance norms corresponding to both indirect taxes and transaction taxes.

- For an international business operating in different countries it allows importing transactions carried out following different country specific tax logic into one cumulative report.

Enhancements for US Sales Tax

SuiteTax when it was rolled out incorporated enhancements to adhere to the US Sales Tax calculation. The 2019.2, version of SuiteTax now supports Zip+4 tax calculation logic so that the variable taxes are accurately determined keeping the difference between origin and destination states as well as the same between interstate vs intrastate sales in consideration. SuiteTax also supports the tax rule modified for the state of California.

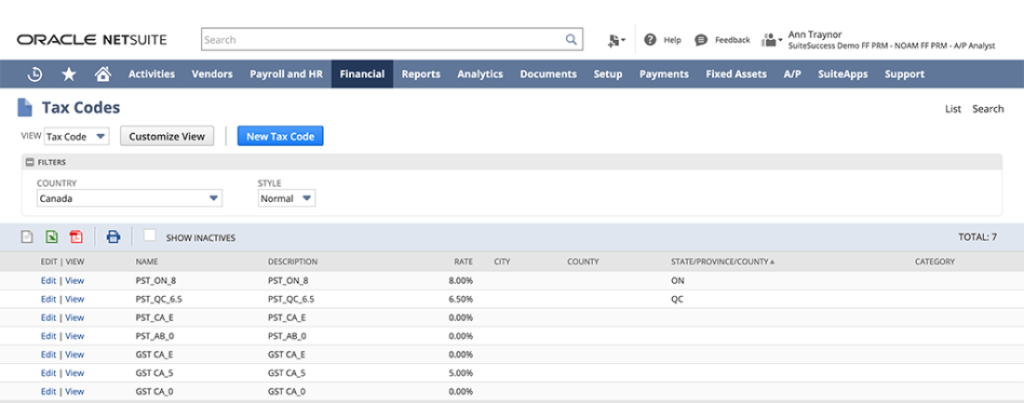

NetSuite offers automatically generated records regarding elements such asTax Accounts, Tax Agencies, Tax Codes & Types, Tax Groups, Tax holidays, etc. Another new tax record element that has been incorporated by NetSuite is ‘US Exemption Certificate’. It allows storing the tax exemption certificates of the customers along with updated expiry dates for each certificate.

Taxation Features for Countries outside of US & Canada

SuiteTax also offers a whole array of enhancements for different use cases that are found in countries outside of US & Canada. Some of the key SuiteTax features and enhancements for other countries include the following.

- Pricing after tax calculation: This feature allows presenting the price of products to the customers after applying the tax as per the norm of the country.

- A separate date for tax calculation: As per this feature a separate date different from the NetSuite transaction date is used for calculation and reporting of taxes.

- Tax returns in local formats: This SuiteTax feature allows preparing tax returns in the country specific format. As per this feature some countries can just streamline the process by allowing NetSuite to submit the electronically filed tax form to the respective authority.

Adhering to Complicated US Tax Rules

NetSuite SuiteTax is particularly helpful for organisations operating in the US to adhere to the complex tax calculation and reporting needs. NetSuite SuiteTax ensures automating the tax calculation process while reducing physical efforts and anticipation leading to unwanted errors. SuiteTax comes with latest enhancements that fully adhere to the federal US tax rules and local tax rules.

Let’s have a look at how these SuiteTax enhancements really help.

- SuiteTax with these enhancements help keep the business updated on sales and use tax rates. SuiteTax ensures that the accurate tax rates are implemented for every sale.

- SuiteTax also allows setting the right tax exemption status for particular customers and purchase cases where buyers are not likely to be charged with sales taxes when buying certain products and services.

- SuiteTax also allows customers to check whether they are eligible for tax exemption before purchasing and making the final transaction.

- SuiteTax also keeps the business process and all transactions up to date with the latest rules, standards, reporting needs and practises.

VAT/GST calculation in Europe & Asia

By using the SuiteTax, a business can efficiently deal with the complications and requirements pertaining to the Value Added Tax (VAT) across different jurisdictions all over Europe and Asia. Let’s have a quick look at some of the key ways SuiteTax help adhering to the country specific VAT and GST regulations.

- SuiteTax as the comprehensive tax calculation system can handle all types of transactions subjected to diverse tax requirements such as VAT, GST, sales tax, cross-border taxation, intra-EU transactions, 3PL, reverse charges, deductible VAT, and several others.

- SuiteTax helps manage all transactions both within the country and across international locations by following the rules for particular countries and regions.

- SuiteTax is capable of implementing monthly rate updates from different countries and details of automatically deducted taxes from 100+ countries.

- SuiteTax offers a detailed history of records corresponding to different tax changes and thus remains open to evaluation and checks.

- When calculating taxes SuiteTax automatically incorporated crucial company details such as the legal company or brand name, company address, consultation number, and date stamp.

- SuiteTax comes with a very advanced tax identification logic to streamline the tax calculation process for any business.

- SuiteTax comes with a robust range of localisation features including automated country-specific tax calculation and returns, generating cross-border tax reports, and custom templates for specific tax requirements in a region.

Indian GST

Indian companies can also take advantage of SuiteTax implementation as it can automate tax calculation and reporting with a rule-based tax engine adhering to the Good and Service Tax (GST) regulations and Tax Deducted at Source (TDS) rules. Let’s have a quick look at some of the key ways SuiteTax meets Indian GST regulations.

- SuiteTax provides integrated support for Permanent Account Number (PAN) and Goods and Tax Identification Number (GSTIN) by providing a valid format accommodating inputs of these two numbers.

- It allows transactions through SEZ.

- It helps companies easily set up tax rules by including types of Pre-seeded Tax, different SAC codes, and different codes of TDS section.

- It allows the vendors to handle various exceptions and limits for TDS.

- SuiteTax also supports other taxes and statutory charges such as education cess, secondary education ces, TDS surcharge tax, etc.

- SuiteTax allows Indian companies to streamline tax calculation on challans and helps them create detailed reports on business revenues and tax components.

Conclusion

SuiteTax as the most sophisticated tax calculation tool from NetSuite already looks formidable enough for organisations to streamline their processes. Ban organisations can further get maximum from this tax calculation suite by partnering with a custom NetSuite implementation company with SuiteTax expertise.