QuickBooks offers a logical and cost-effective solution to manage basic accounting functions for many organizations that are about to begin their journey. But as businesses scale and their financial operations become more complex, the limitations of entry-level software begin to surface. Managing complex accounting workflows with spreadsheets and disconnected tools increases the risk of financial errors and inefficiencies.

In fact, a report by TechValidate revealed that over 90% of companies that switched from QuickBooks to NetSuite saw an improvement in accounting efficiency within the first year. This is why growth-focused organizations often transition to NetSuite and work with a trusted NetSuite implementation partner to future-proof their financial infrastructure.

Though QuickBooks meets the needs of early-stage businesses, it simply does not scale effectively. Upgrading to NetSuite relieves finance teams from manual bottlenecks and empowers companies with unified, cloud-based systems that drive long-term growth.

Before diving into the advantages of NetSuite implementation for SaaS companies , let’s first examine the warning signs that your current system is no longer serving your business goals.

Top 3 Signs Indicating When to Switch from QuickBooks to NetSuite

If your finance team is facing constant delays or data discrepancies, it might be the right time to reassess your software stack. The following signs highlight when QuickBooks is no longer sufficient:

1. Lack of Real-Time Visibility

In a fast-paced financial industry, consolidated dashboards and real-time reporting are critical. QuickBooks does not provide a unified view of your business operations, which makes it difficult to track performance across departments. This lack of transparency leads to delays, poor forecasting, and missed compliance obligations. Thereby, strategic decision-making is compromised due to outdated or inaccessible data.

2. Ineffective Inventory Management

QuickBooks lacks comprehensive tools for inventory and warehouse management. Users often rely on manual updates or physical checks to track stock levels, which slows down operations and increases the risk of human error. This disconnects between inventory data and financial systems creates bottlenecks in order fulfillment, disrupts supply chain planning, and frustrates customers with avoidable delays.

3. Over-Reliance on Excel Spreadsheets

Due to limited reporting capabilities, QuickBooks users often turn to Excel for financial calculations and analysis. Spreadsheets are helpful but they cannot provide the automation, control, or accuracy required for modern accounting. Manual entry not only wastes valuable time but also increases the chances of reporting inconsistencies and audit risks. Ultimately, Excel becomes a workaround instead of a solution.

Why Choose NetSuite over QuickBooks

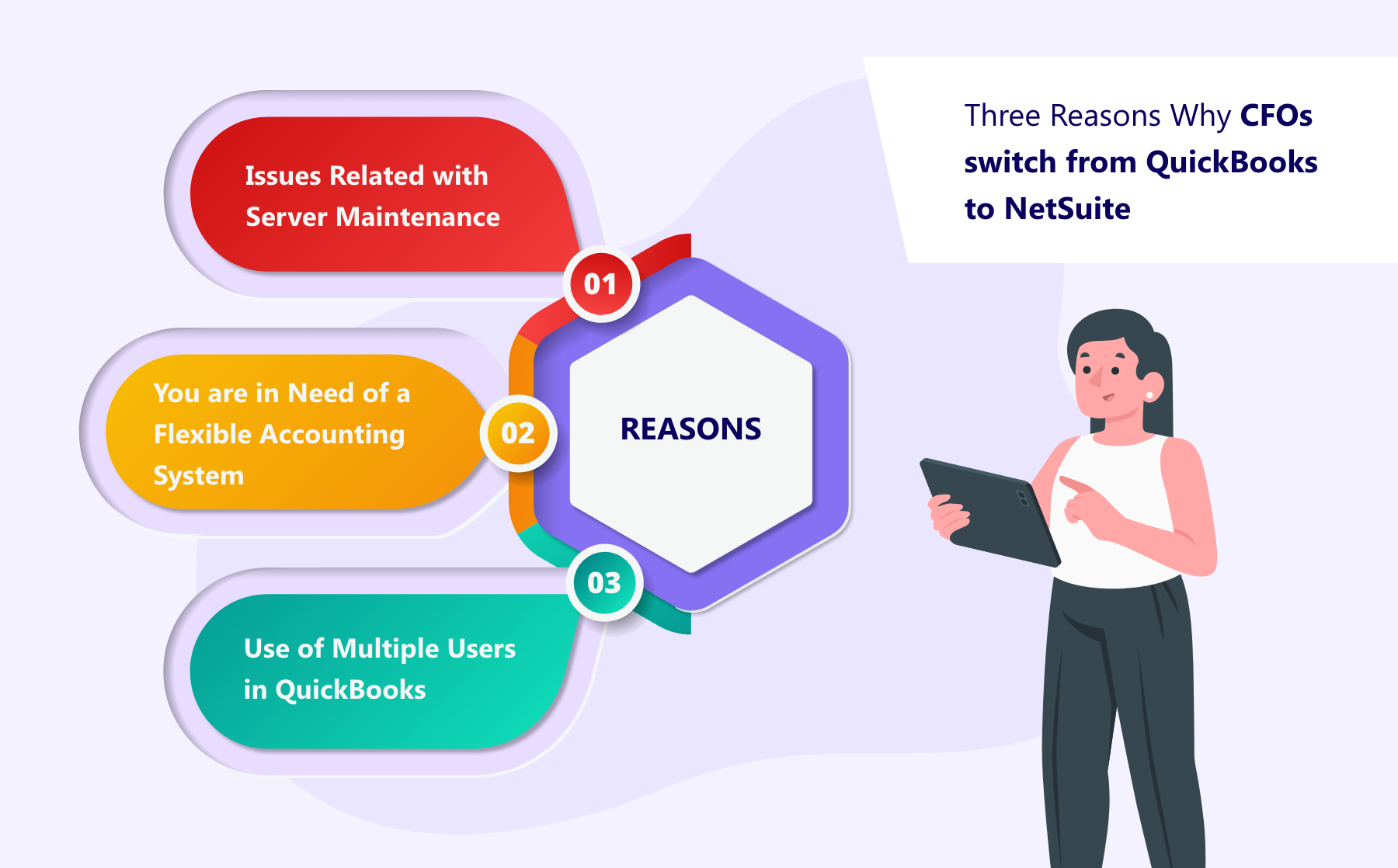

CFOs and finance leaders are increasingly moving to NetSuite to support growing organizational needs. The following reasons explain this shift-

- Server Maintenance and Infrastructure Challenges

QuickBooks Desktop requires on-premise servers when dealing with international banking or complex financial tasks. This setup increases operational costs and limits flexibility. In fact, IT teams must maintain infrastructure solely for QuickBooks which drains resources and limits scalability. On the other hand, NetSuite’s cloud architecture eliminates server dependency, supports remote work, and simplifies IT management which makes operations more resilient and cost-effective.

- Scalable and Flexible Accounting System

As organizations grow, QuickBooks can’t keep up with expanding departments, subsidiaries, or geographies. In fact, managing multiple tools and entering duplicate data slows down operations and increases errors. But NetSuite offers seamless scalability, integrating everything from financial management to CRM, supply chain, and beyond. It adapts to complex structures while maintaining consistent and accurate reporting, positioning your company for sustainable growth.

- Limited Multi-User Access

QuickBooks restricts the number of concurrent users and requires installation on specific devices. This limits collaboration and slows down team productivity. If a team member needs to access data from another machine, the software must be reinstalled to add friction to daily workflows. NetSuite solves this issue with browser-based access and role-based permissions, allowing multiple users to work securely and simultaneously, regardless of location.

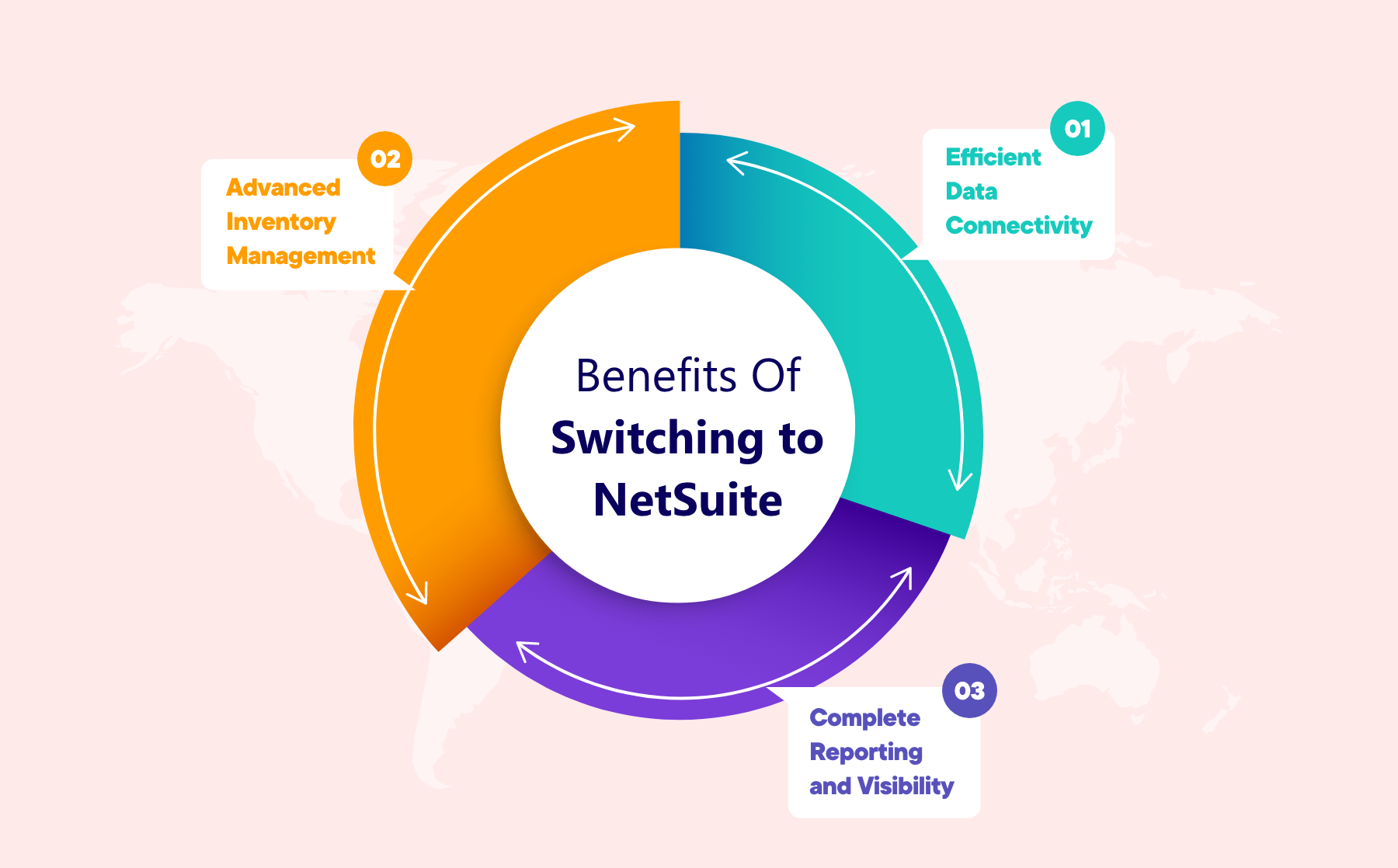

Top 3 Wins of Using the Best ERP for SaaS Companies

NetSuite is not just an accounting platform, but a complete ERP solution designed for scalability, integration, and real-time financial management. The following results make it an ideal upgrade from QuickBooks to NetSuite:

1. Comprehensive Reporting and Real-Time Visibility

NetSuite consolidates financial and operational data across departments for delivering accurate and real-time insights through customizable dashboards. Also, finance leaders can monitor KPIs, generate reports on demand, and ensure compliance with changing regulations. This 360-degree visibility eliminates guesswork, empowers proactive decision-making, and enhances overall financial control capabilities that QuickBooks simply cannot offer at scale.

2. Advanced Inventory Management

NetSuite’s built-in warehouse and NetSuite inventory management features offer automated tracking, real-time stock updates, and seamless order fulfillment. This reduces manual intervention, improves supply chain visibility, and enables accurate forecasting. Organizations benefit from efficient workflows, reduced holding costs, and better customer service. Therefore, all these are the critical factors for growing product-based businesses looking to optimize operations.

3. Seamless Data Connectivity and Access

Users can access real-time data from anywhere without relying on disconnected spreadsheets or VPNs with NetSuite’s cloud-based architecture. In fact, role-based access ensures data integrity and minimizes risk. Whether it is the CFO reviewing forecasts or a manager tracking departmental budgets, everyone sees consistent, up-to-date information for driving collaboration and performance at every level of the organization.

Also Read: How to Choose the Right Accounting Software for Your Business

NetSuite vs QuickBooks for SaaS

Though both NetSuite and QuickBooks serve as accounting solutions, their capabilities diverge significantly, especially for SaaS companies. Let’s have a look at QuickBooks vs NetSuite for startups and other growing companies:

- Revenue Recognition

NetSuite automates revenue recognition for one-time sales, bundled deliverables, or time-based services. As a result, the SaaS companies can make sure ASC 606 compliance with real-time updates to financial statements. But QuickBooks relies heavily on manual journal entries and spreadsheets, which reduces accuracy and increases time spent on compliance.

- Billing

NetSuite simplifies complex billing models, supporting fixed, usage-based, and hybrid subscriptions. SuiteBilling allows consolidation of charges into a single invoice, automates renewals, and handles promotional discounts. QuickBooks lacks robust subscription billing features, requiring manual tracking and offering limited customization for pricing models.

- General Ledger

NetSuite’s general ledger supports multiple books, currencies, and automated allocations. Also, it enables multidimensional reporting and detailed audit trails with customizable GL impact lines. QuickBooks offers basic GL functionality with limited tracking dimensions, making it harder to meet compliance and reporting standards as your SaaS company scales.

- Accounts Payable

NetSuite’s approval workflows and role-based access promote internal controls and fraud prevention. It automates exception handling when invoices don’t match POs and ensures compliance even in distributed teams. QuickBooks lacks built-in purchasing controls and approval workflows, increasing risks in financial operations.

- Accounts Receivable

NetSuite AR offers automated invoice tracking, dashboards, and customer self-service portals. It handles deferred revenue, contract billing, and real-time customer aging. Though QuickBooks can track basic AR, it lacks advanced forecasting tools and requires more manual intervention to handle recurring revenue or anomalies.

- Fixed Asset and Lease Management

NetSuite manages an asset’s entire lifecycle – including amortization, depreciation, and disposal. It also supports lease accounting compliance. QuickBooks does not offer fixed asset or lease management features, requiring external systems or spreadsheets for asset tracking and reporting.

- Inventory Management

NetSuite automates inventory tracking with real-time visibility, barcode scanning, and multi-location support. SaaS companies offering hardware or bundled solutions benefit from warehouse integration. QuickBooks provides only limited inventory tools and lacks advanced warehouse management features.

- Reporting

NetSuite provides dynamic, real-time reporting across departments, subsidiaries, and currencies. Its drill-down functionality allows SaaS companies to analyze data from multiple perspectives instantly. QuickBooks offers static reports with limited customization, which makes it challenging to support multi-entity, multicurrency, or consolidated reporting needs.

Conclusion

QuickBooks remains a solid foundation for startups, but when businesses begin to scale, inefficiencies, data silos, poor visibility, and limited scalability start to emerge. QuickBooks alternatives for SaaS, i.e., NetSuite, solve these pain points with a unified, cloud-based ERP platform designed for growth, automation, and strategic control.

If your organization is ready to move beyond manual processes and explore more innovative financial management, VNMT Solutions can guide your transition with tailored implementation and integration support. With years of experience helping businesses scale successfully, VNMT ensures a smooth migration from QuickBooks to NetSuite.

Still on QuickBooks? It may be holding your SaaS company back.

Switch to NetSuite with VNMT Solutions – your trusted NetSuite implementation partner. We help SaaS businesses migrate seamlessly, optimize operations, and realize ROI faster with tailor-made configurations.

Follow VNMT Solutions on LinkedIn for NetSuite tips, success stories, and ERP best practices tailored to finance leaders and business owners.